Trump Tariffs Spark Global Market Crash: What You Need to Know

On April 2, 2025, the world economy was shaken by a bold announcement: President Donald Trump introduced sweeping new import taxes, now widely known as Trump tariffs. The impact was immediate and severe. Global stock markets plummeted, with the S&P 500 alone dropping nearly 11% in just two days, wiping out over $6 trillion in market value.

As a crypto miner , I usually keep my eyes glued to GPU prices and electricity rates. But when Trump tariffs rock global financial systems this hard, even the mining world can’t ignore it. This affects everything—from mining profitability and GPU prices to inflation and investor confidence.

What Are Trump Tariffs and Why Now?

Trump’s April 2 announcement introduced a 10% blanket tariff on all imports, with higher levies targeting economic giants like China, the European Union, Japan, and Vietnam. According to Trump, the move is aimed at fixing trade imbalances and encouraging U.S.-based manufacturing.

But markets hate surprises. These Trump tariffs caught investors off guard, and the immediate result was panic. Tariffs act as a tax on imported goods, which increases costs for businesses and consumers alike.

How the Markets Reacted

The Trump tariffs sent shockwaves across the financial world. The S&P 500 dropped nearly 11% in 48 hours, while the Dow Jones and Nasdaq also took heavy hits. CNBC’s Jim Cramer compared the situation to the infamous Black Monday (1987) crash.

International markets fared no better. Australia’s ASX 200 braced for a $114 billion drop, and European indexes nosedived. Even Bitcoin fell 9% overnight, dragging down Ethereum, Solana, and other altcoins.

Escalation: A Brewing Trade War?

In retaliation, China quickly imposed tariffs on U.S. goods. The European Union is preparing countermeasures. This tit-for-tat response raises the threat of a full-blown global trade war—something that hasn’t been seen since the early 20th century.

What It Means for Canadian Crypto Miners

- GPU Prices May Rise: If tariffs disrupt supply chains or increase import fees, miners could face much higher gear costs.

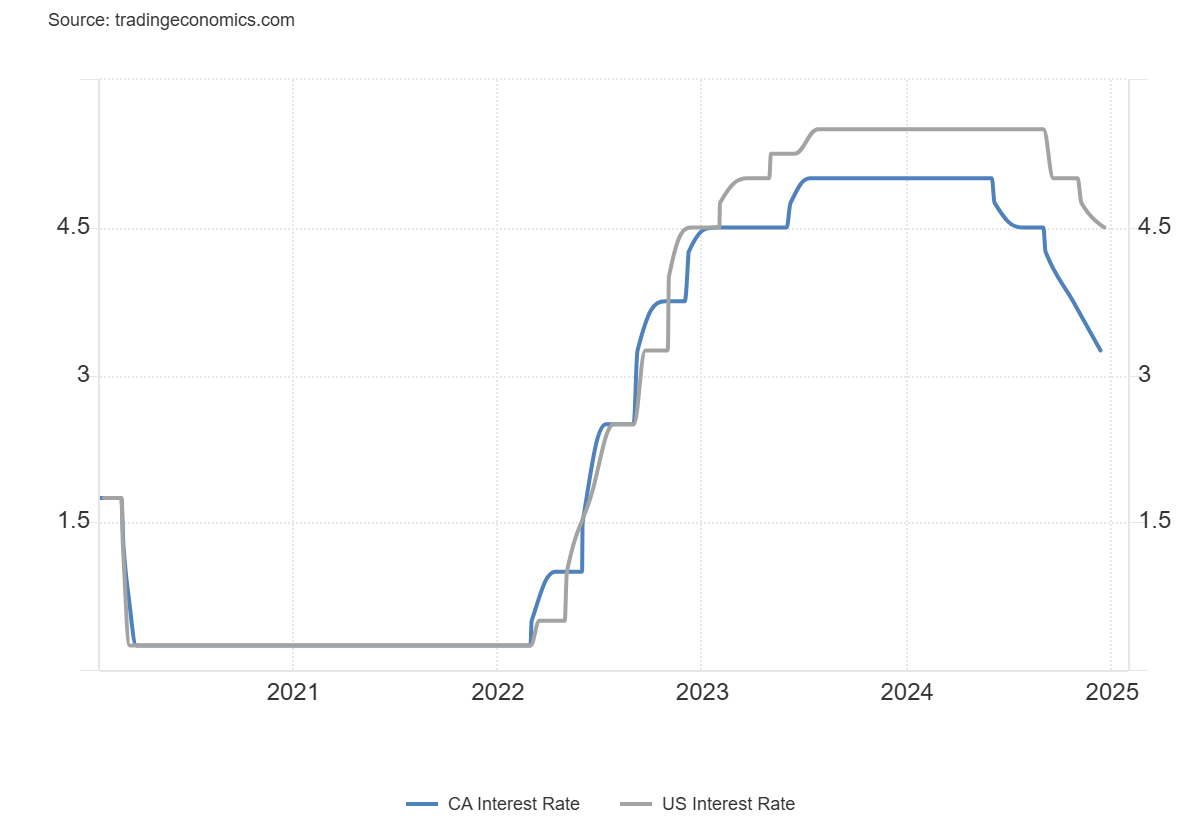

- Weaker CAD: Global instability might weaken the Canadian dollar, making imported tech pricier.

- Inflation: Higher import costs across sectors could drive inflation, including energy costs.

- Recession Watch: JPMorgan now puts the odds of a global recession at 60%. If that happens, speculative investments (like crypto) may cool significantly.

How to Adapt Your Mining Strategy

If you’re mining in Canada right now, here’s how you can protect your bottom line amid the fallout from Trump tariffs:

- Avoid major hardware purchases unless you’re getting a killer local deal.

- Spec mine with efficiency in mind—use low-power GPUs or repurpose existing setups.

- Maintain a cash reserve to cover unexpected cost increases.

- Stay plugged in. Follow CanadianCryptoMining.com for regular updates and tips.

Final Thoughts

The ripple effects of Trump tariffs are just starting to spread. Whether you’re trading, mining, or just watching the headlines, this is a moment of change. Economic policy has real-world effects—even for hobbyist miners in Canada.

Got questions? Leave a comment or check out my Beginner’s Guide to Crypto to get started.

📩 Sign up for our newsletter to stay updated on blockchain trends, crypto mining tips, and more!